Table of Contents

- U.S. Dollar Index Chart — DXY Quotes — TradingView — India

- US Dollar Index News: DXY Hits One-Week High Ahead of Key US Employment ...

- DXY - TRADING11

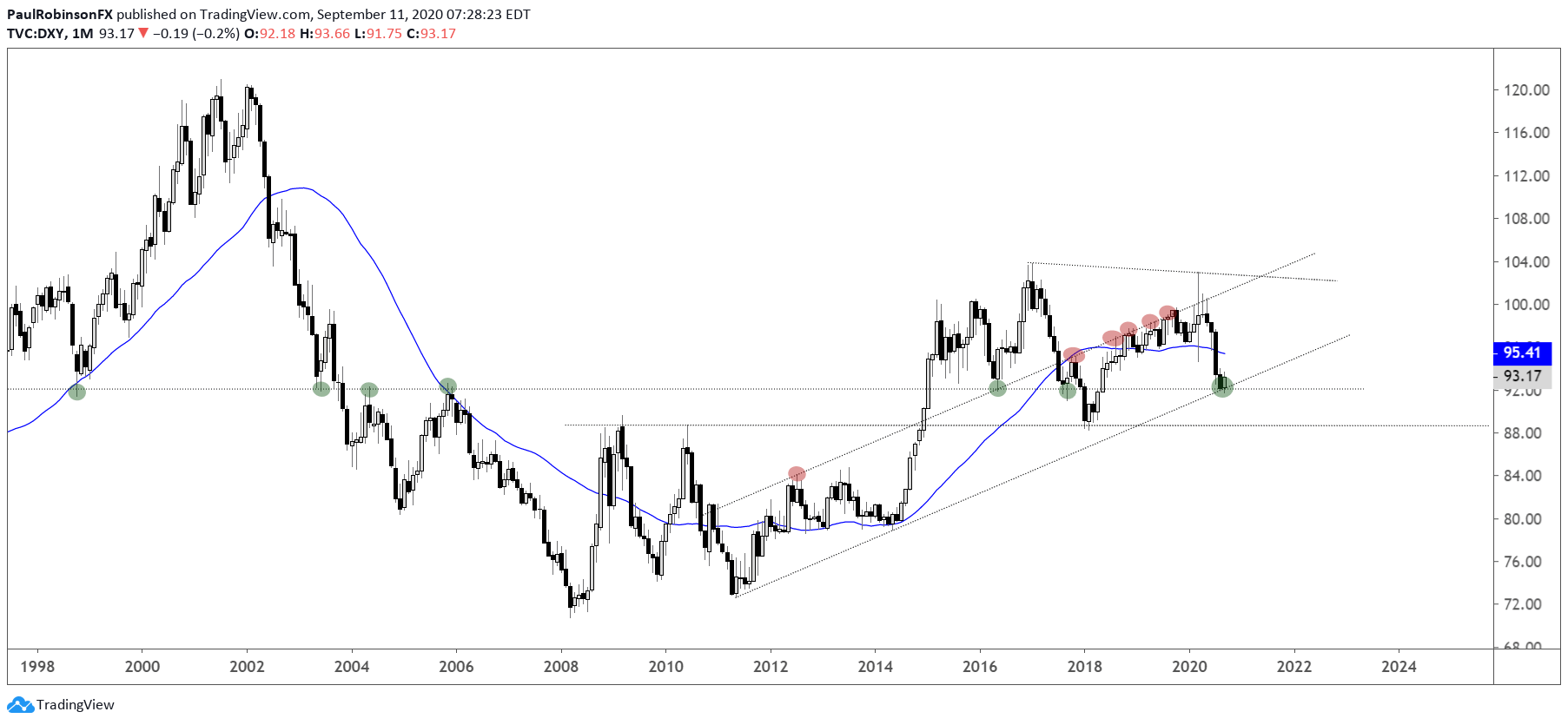

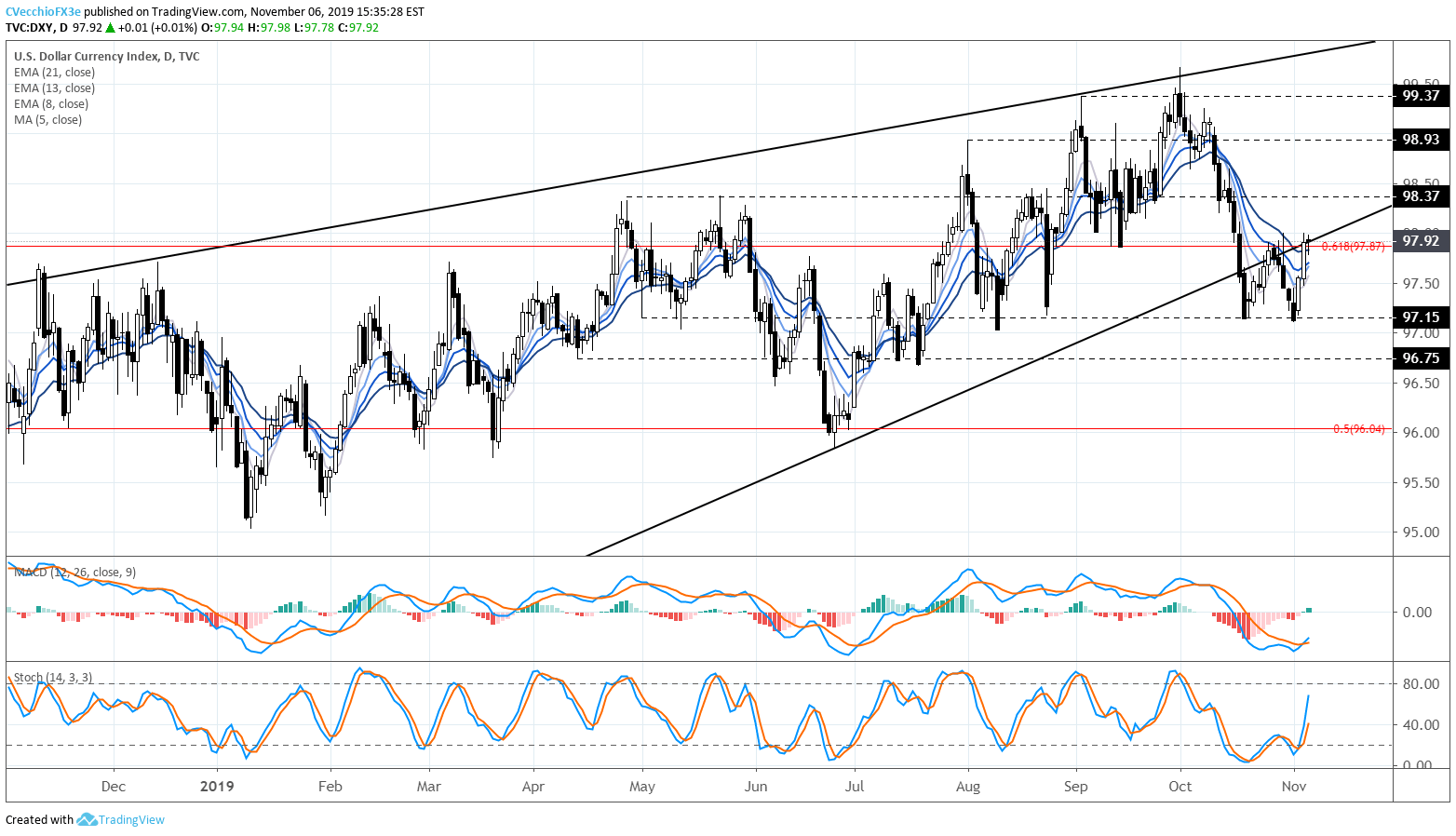

- US Dollar Forecast: DXY Index Hits Critical Resistance - Levels for USD/JPY

- DXY Dollar Index Technical Analysis Update - Price News of the DXY ...

- U.S. Dollar Index Chart — DXY Quotes — TradingView — India

- US Dollar Index Price Analysis: DXY breaks weekly support with eyes on ...

- EUR/USD, USD/CAD, DXY – Dollar Charts for Next Week

- Chỉ số DXY là gì? Tác động của DXY đến thị trường chứng khoán Việt Nam

- US Dollar Index News: DXY Rises as Treasury Yields Edge Higher

What is the U.S. Dollar Index (DXY)?

Components of the DXY

Significance of the DXY

The DXY is an important indicator of the strength of the U.S. dollar and its impact on the global economy. A strong dollar can make U.S. exports more expensive for foreign buyers, potentially leading to a decrease in exports and a trade deficit. On the other hand, a weak dollar can make U.S. exports more competitive, potentially leading to an increase in exports and a trade surplus.

Tracking DXY Stock Prices and Charts

Investors and traders can track the DXY stock prices and charts on various financial websites, including the Wall Street Journal (WSJ). The WSJ provides up-to-date information on the DXY, including current prices, historical data, and interactive charts. To track the DXY on the WSJ website, follow these steps: 1. Visit the WSJ website and navigate to the "Markets" section. 2. Click on "Currencies" and select "U.S. Dollar Index" from the dropdown menu. 3. View the current price and chart of the DXY, as well as historical data and news articles related to the index. The U.S. Dollar Index (DXY) is a vital indicator of the strength of the U.S. dollar and its impact on the global economy. By understanding the components and significance of the DXY, investors and traders can make informed decisions about their investments and stay up-to-date on the latest market trends. Whether you're a seasoned investor or just starting out, tracking the DXY stock prices and charts on the WSJ website is a great way to stay informed and make informed investment decisions.For more information on the DXY and other financial markets, visit the Wall Street Journal website.

Note: The article is optimized for SEO with the following keywords: U.S. Dollar Index, DXY, stock prices, charts, WSJ, currency strength, global economy. The article is written in a friendly and informative tone, with headings and subheadings to make it easy to read and understand. The HTML format is used to make the article visually appealing and easy to navigate.